- BEPI Alumni - Student Success Stories

- 2024 Hispanic Index of Consumer Sentiment

- 2023 Hispanic Index of Consumer Sentiment

- 2022 Hispanic Index of Consumer Sentiment

- 2021 Hispanic Index of Consumer Sentiment

- 2020 Hispanic Index of Consumer Sentiment

- 2019 Hispanic Index of Consumer Sentiment

- 2018 Hispanic Index of Consumer Sentiment

- 2017 Hispanic Index of Consumer Sentiment

- 2016 Hispanic Index of Consumer Sentiment

- 2015 Hispanic Index of Consumer Sentiment

- 2014 Hispanic Index of Consumer Sentiment

- Join the Business and Economics Polling Initiative Today!

- Participating Students 2024-2025

- People

- Virtual National Conference of Undergraduate Research 2021

- Virtual Florida Undergraduate Research Conference 2021

- National Conference on Undergraduate Research 2019

- Florida Undergraduate Research Conference 2019

- National Conference on Undergraduate Research 2018

- Florida Undergraduate Research Conference 2018

- Undergraduate Research Symposium 2018

- Florida Undergraduate Research Conference 2017

- FAU Graduate Research Day 2017

- Undergraduate Research Symposium 2017

- Florida Undergraduate Research Conference 2016

- FAU Graduate Research Day 2016

- Undergraduate Research Symposium 2016

BEPI Hispanic Index of Consumer Sentiment

Forth Quarter 2025

HISPANICS CONSUMER CONFIDENCE IS STRONGER GOING INTO 2026

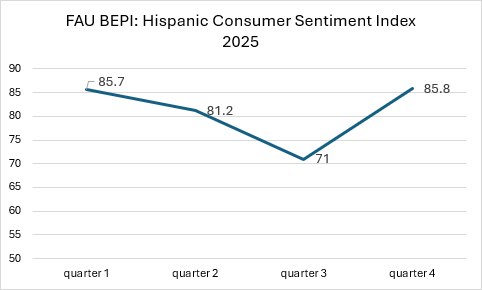

Hispanics in the United States are feeling more optimistic about their financial situation as they enter 2026. The fourth-quarter Hispanic Consumer Sentiment Index (HCSI) rose to 85.8, an increase of 14 points from the third quarter reading of 71. This brings the index back to roughly the same level observed in the first quarter of 2025.

Below are the detailed results of the five questions used to generate the Hispanic Consumer Sentiment Index:

Overall, optimism increased across all five questions used to construct the Hispanic Consumer Sentiment Index compared to the third quarter. Detailed results are presented below:

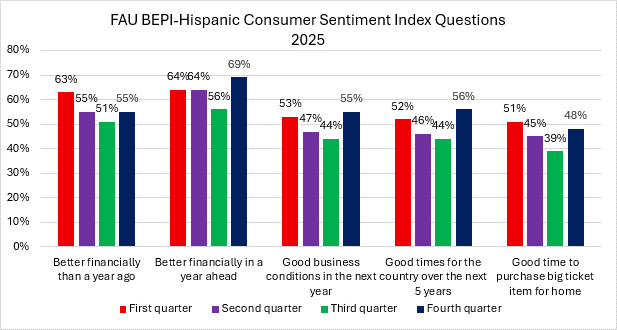

- Current financial situation: In the fourth quarter, 55% of Hispanics said they are better off financially than a year ago, up from 51% in the third quarter.

- Expected financial situation: In the fourth quarter, 69% of Hispanics said they expect to be better off financially in the next year, compared to 56% in the third quarter.

- Short-run economic outlook: 55% of Hispanics expect the country to experience good business conditions in the near term, up from 44% in the third quarter.

- Long-run economic outlook: 56% of Hispanics expect the country’s economic outlook to be good over the next five years, compared to 44% in the third quarter.

- Buying big-ticket items: In the fourth quarter, 48% of Hispanics believe it is a good time to buy big-ticket items, up from 39% in the third quarter.

Other key findings:

- Buying a house: In the fourth quarter, 46% of Hispanics think it is a good time to buy a house, compared to 38% in the third quarter.

- Buying a car: In the fourth quarter, 50% of Hispanics think it is a good time to buy a car, up from 46% in the third quarter.

- Cost of living: In the fourth quarter, 72% of Hispanics reported that the cost of living has increased, compared to 69% in the third quarter.

The poll is based on a panel sample of Hispanic adults, 18 years of age and older. The survey was administered using both landlines via IVR data collection and online data collection using Rep data. There were 540 respondents sampled between October 1 and December 31, 2025, and a margin of error of +/- 4.2 percentage points. Responses for the entire sample were weighted to reflect the national distribution of the Hispanic population by gender, age, education, and income according to latest American Community Survey data.

Third Quarter 2025

HISPANICS CONSUMER CONFIDENCE DECREASED IN THE THIRD QUARTER OF 2025

The Hispanic Consumer Sentiment Index (HCSI) in the third quarter of 2025 finds that the Hispanic population’s consumer confidence in the U.S. decreased compared to the second quarter. Specifically, the Hispanic Consumer Sentiment Index (HCSI) decreased from 81.2 in the second quarter to 71 in the third quarter and 85.7 in the first quarter of 2025.

Overall, there is a decrease in optimism in all the five questions used to generate the Hispanic Consumer Sentiment Index when compared to the second quarter of 2025. Below are the detailed results:

- In the third quarter of 2025, 51% of Hispanics said they are better off financially than a year ago compared to 55% in the second quarter and 63% in the first quarter of 2025.

- In the third quarter of 2024, 56% of Hispanics are more optimistic about their future financial situation compared to 64% in the second and 64% in the first quarter of 2025.

- Regarding the short run economic outlook of the country, 44% of Hispanics said they expect the country as a whole to experience good business conditions in the upcoming year compared to 47% in the second quarter and 53% in the first quarter of 2025.

- In terms of the long run economic outlook of the country, 44% of Hispanics are slightly more optimistic compared to 46% in the second quarter and 52% in the first quarter of 2025.

- In the third quarter of 2025, 39% percent of Hispanics think it is a good time to buy big- ticket items compared to 45% percent in the second quarter and 51% in the first quarter of 2025.

Other key findings:

- Cost of living: % of Hispanics said the cost of living has gone up compared to 69% in the second quarter and 68% in the first quarter of 2025.

- Buying a house: % Hispanics think it is good time to buy a house compared to 38% in the second quarter and 51% in the first quarter of 2025.

- Buying a Car: % Hispanics think it is a good time to buy a car compared to 46% in the second quarter and 41% in the first quarter of 2025.

The survey is based on a panel sample of Hispanic adults, 18 years of age and older. The survey was administered using both landlines via IVR data collection and online data collection using Dynata. There were 539 respondents sampled between July 1 and September 30, 2025, with a margin of error of +/-4.22 percentage points. Responses for the entire sample were weighted to reflect the national distribution of the Hispanic population by region, education, gender, age and income according to latest American Community Survey data.

Second Quarter 2025

HISPANICS LESS OPTIMISTIC OF THE ECONOMIC OUTLOOK IN THE NATION

The Hispanic Consumer Sentiment Index (HCSI) in the second quarter of 2025 finds that the Hispanic population’s consumer confidence in the U.S. has slightly decreased compared to the first quarter. Specifically, the Hispanic Consumer Sentiment Index (HCSI) decreased from 85.7 in the first quarter of 2025 to 81.24 in the second quarter and 89.6 in the last quarter of 2024.

Overall, there is a decrease in optimism in four out of the five questions used to generate the Hispanic Consumer Sentiment Index. Below are the detailed results:

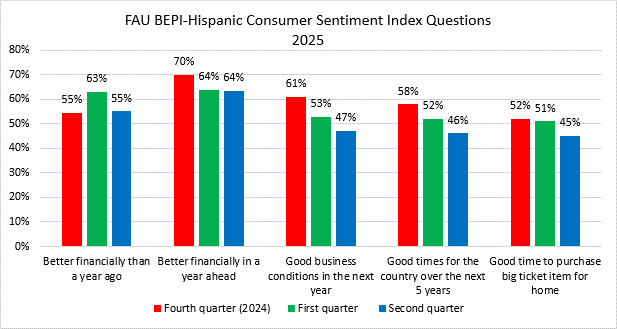

- In the second quarter of 2025, 55% of Hispanics said they are better off financially than a year ago which compared to 63% percent in the first quarter and 55% in the last quarter of 2024.

- In the second quarter of 2025, 64% of Hispanics felt optimistic about their future financial situation, unchanged from the first quarter but 6 points lower than last quarter of 2024.

- Regarding the short run economic outlook of the country, 47% of Hispanics said they expect the country as a whole to experience good business conditions in the upcoming year compared to 53% in the first quarter and 61% in the last quarter of 2024.

- In terms of the long run economic outlook of the country, 46% of Hispanics are less optimistic compared to 52% in the first quarter and 58% in the last quarter of 2024.

- In the second quarter of 2025, 45% percent of Hispanics think it is a good time to buy big- ticket items compared to 51% percent in the first quarter and 52% in the last quarter of 2024.

Other key findings:

- Cost of living: 69% of Hispanics said the cost of living has gone up compared to 68% in the previous quarter and 78% in the last quarter of 2024.

- Buying a house: 38% of Hispanics think it is good time to buy a house compared to 51% in the in the previous quarter and 41% in the last quarter of 2024.

- Buying a Car: 46% of Hispanics think it is a good time to buy a car compared to 41% in the previous quarter and 51% in the last quarter of 2024.

The survey is based on a panel sample of Hispanic adults, 18 years of age and older. The survey was administered using both landlines via IVR data collection and online data collection using Dynata. There were 540 respondents sampled between April 1 and June 30, 2025 with a margin of error of +/-4.21 percentage points. Responses for the entire sample were weighted to reflect the national distribution of the Hispanic population by region, education, gender, age and income according to latest American Community Survey data.

First Quarter 2025

HISPANICS ARE LESS OPTIMISTIC OF THEIR PERSONAL FINANCES AND THE ECONOMY

The Hispanic Consumer Sentiment Index (HCSI) in the first quarter of 2025 finds that the Hispanic population’s consumer confidence in the U.S. has decreased compare to the fourth quarter of 2024. Specifically, the Hispanic Consumer Sentiment Index (HCSI) decreased from 89.6 in the fourth quarter of 2024 to 85.7 in the first quarter of 2025.

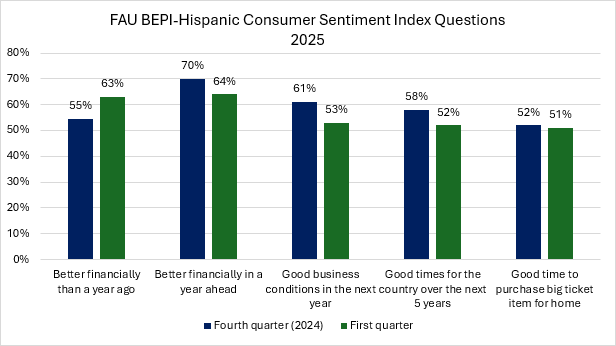

Overall, there is a decrease in optimism in four out of the five questions used to generate the Hispanic Consumer Sentiment Index when compared to the fourth quarter of 2024. Below are the detailed results:

- In the first quarter of 2025, 63% of Hispanics said they are better off financially than a year ago, which is 8 percentage points (55%) higher than the last quarter of 2024.

- In the first quarter of 2025, 64% of Hispanics indicated they will be better off over the next year compared to 70% in the last quarter of 2024.

- Regarding the short run economic outlook of the country, 53% of Hispanics said they expect the country as a whole to experience good business conditions in the upcoming year compared to 61% in the fourth quarter of 2024.

- In terms of the long run economic outlook of the country, Hispanics are less optimistic in the first quarter of 2025 compared to the fourth quarter of 2024 (52% vs. 58%).

- In the first quarter of 2025, 51% percent of Hispanics think it is a good time to buy big ticket items compared to 52% percent in the fourth quarter of 2024.

Other key findings:

- Buying a house: 51% of Hispanics think it is a good time to buy a house compared to 41% in the last quarter of 2024.

- Buying a Car: 41% of Hispanics think it is a good time to buy a car compared to 51% in the last quarter of 2024.

- Cost of living: 68% of Hispanics said the cost of living has gone up compared to 78% in the last quarter of 2024.

The poll is based on a panel sample of Hispanic adults, 18 years of age and older. The survey was administered using both landlines via IVR data collection and online data collection using Dynata. There were 542 respondents sampled between January 1 and March 31, 2025 and a margin of error of +/- 4.21 percentage points. Responses for the entire sample were weighted to reflect the national distribution of the Hispanic population by region, education, gender, age and income according to latest American Community Survey data. The polling results and full cross-tabulations can be viewed on the FAU BEPI website.